Florida International University Foundation and Subsidiaries

Statement of Net Position

Assets| Cash and investments | $310,503,514 |

|---|

| Pledges receivable, net | 19,751,852 |

|---|

Depreciable

capital assets, net |

15,499,057 |

|---|

| Other assets | 622,739 |

|---|

|

|---|

| Total assets | $346,377,162 |

|---|

Liabilities and Net Position| Liabilities | $16,380,370 |

|---|

| Net position | 329,996,792 |

|---|

| | |

|---|

| | |

|---|

|

|---|

| Total liabilities and net position | $346,377,162 |

|---|

Statement of Revenues, Expenses and Changes in Net Position

Revenues| Contributions, net | $26,346,350 |

|---|

| Investment earnings | 8,230,007 |

|---|

| Other revenues | 2,650,239 |

|---|

|

|---|

| Total revenues | $37,226,596 |

|---|

ExpensesPrograms, scholarships and

building support to Florida

International University |

$27,461,363 |

|---|

| Fundraising | 4,369,700 |

|---|

| General and administrative | 3,001,977 |

|---|

General support to

Florida International University |

1,273,868 |

|---|

| Depreciation | 747,787 |

|---|

|

|---|

| Total expenses | $36,854,695 |

|---|

| Other activity | (84,000) |

|---|

|

|---|

| Gain before endowment contributions | 287,901 |

|---|

| Endowment contributions | 5,861,341 |

|---|

|

|---|

| Change in net position | 6,149,242 |

|---|

| Net position, beginning of year | 323,847,550 |

|---|

|

|---|

| Net position, end of year | $329,996,792 |

|---|

Please note: These figures agree with the audited financial statements, which are presented on a full accrual basis.

Impact

The FIU Foundation aims to connect people, passions, and possibilities through philanthropy, financial stewardship, and engagement. The Foundation strives to enrich the quality of education at the university by supporting scholarships, endowed chairs and professorships, and other programs that rely on private funding. The Foundation accepts charitable donations to support FIU in its goal to be a leading urban public research university that is focused on student learning, innovation, and collaboration.

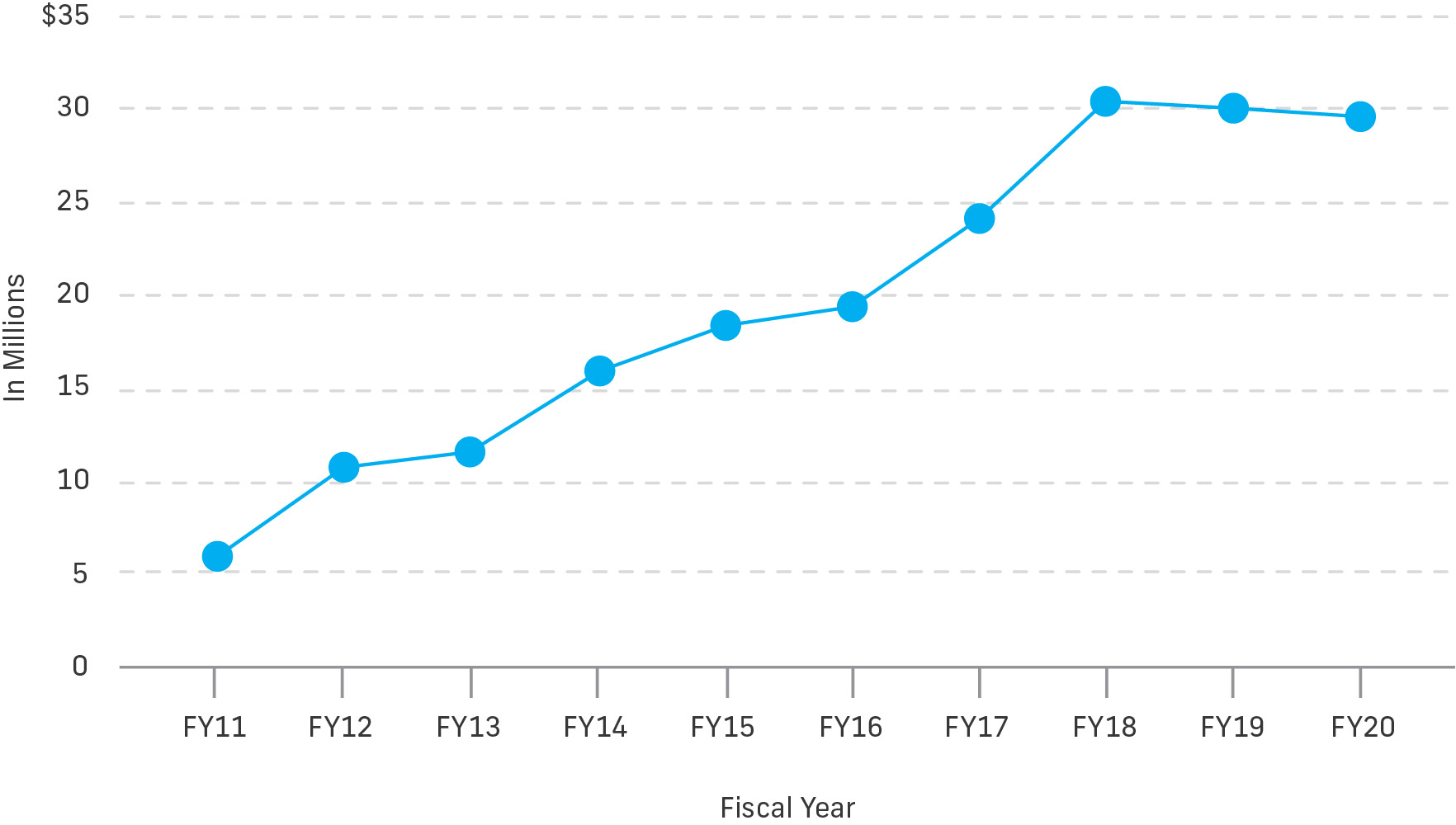

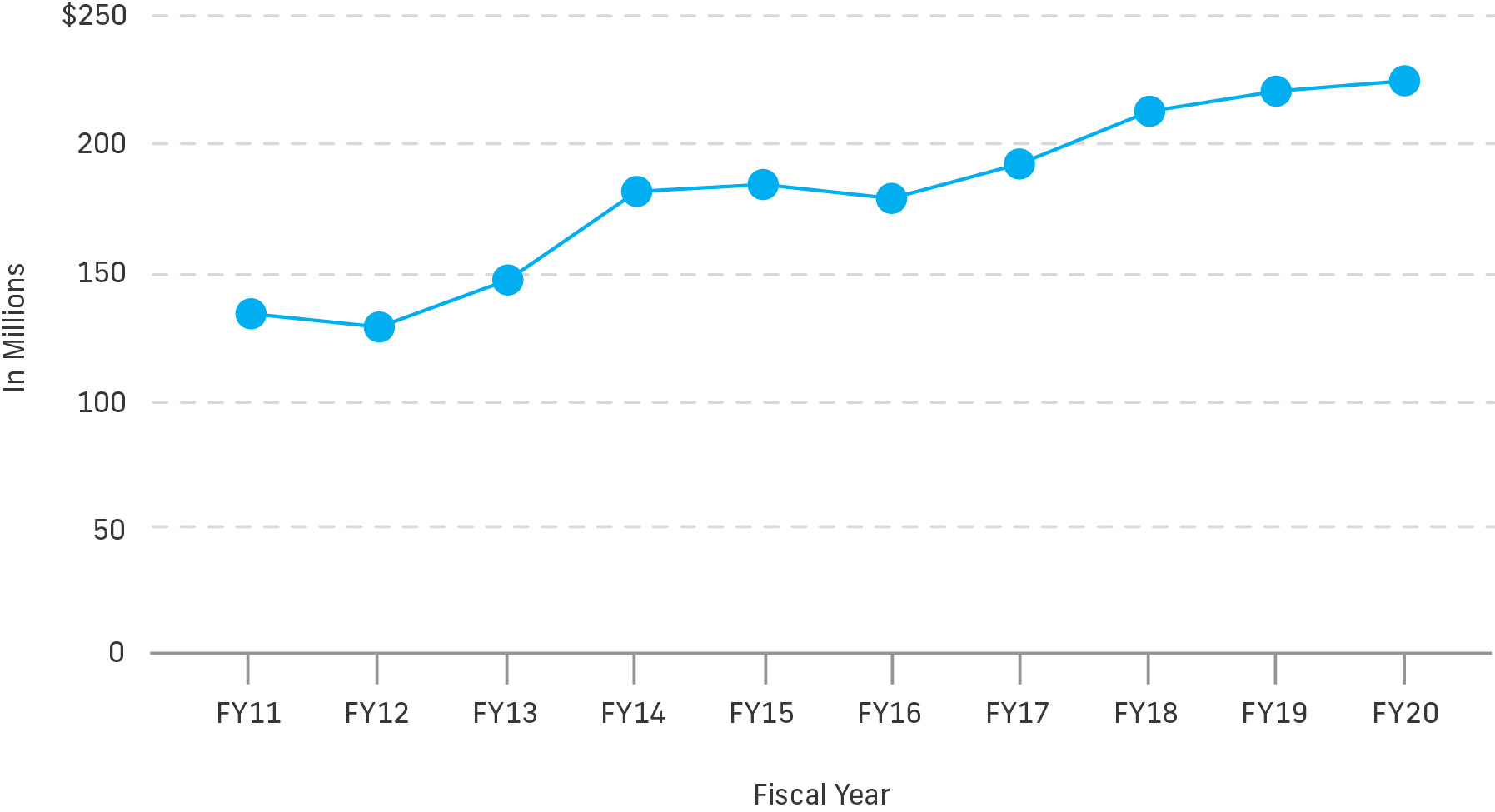

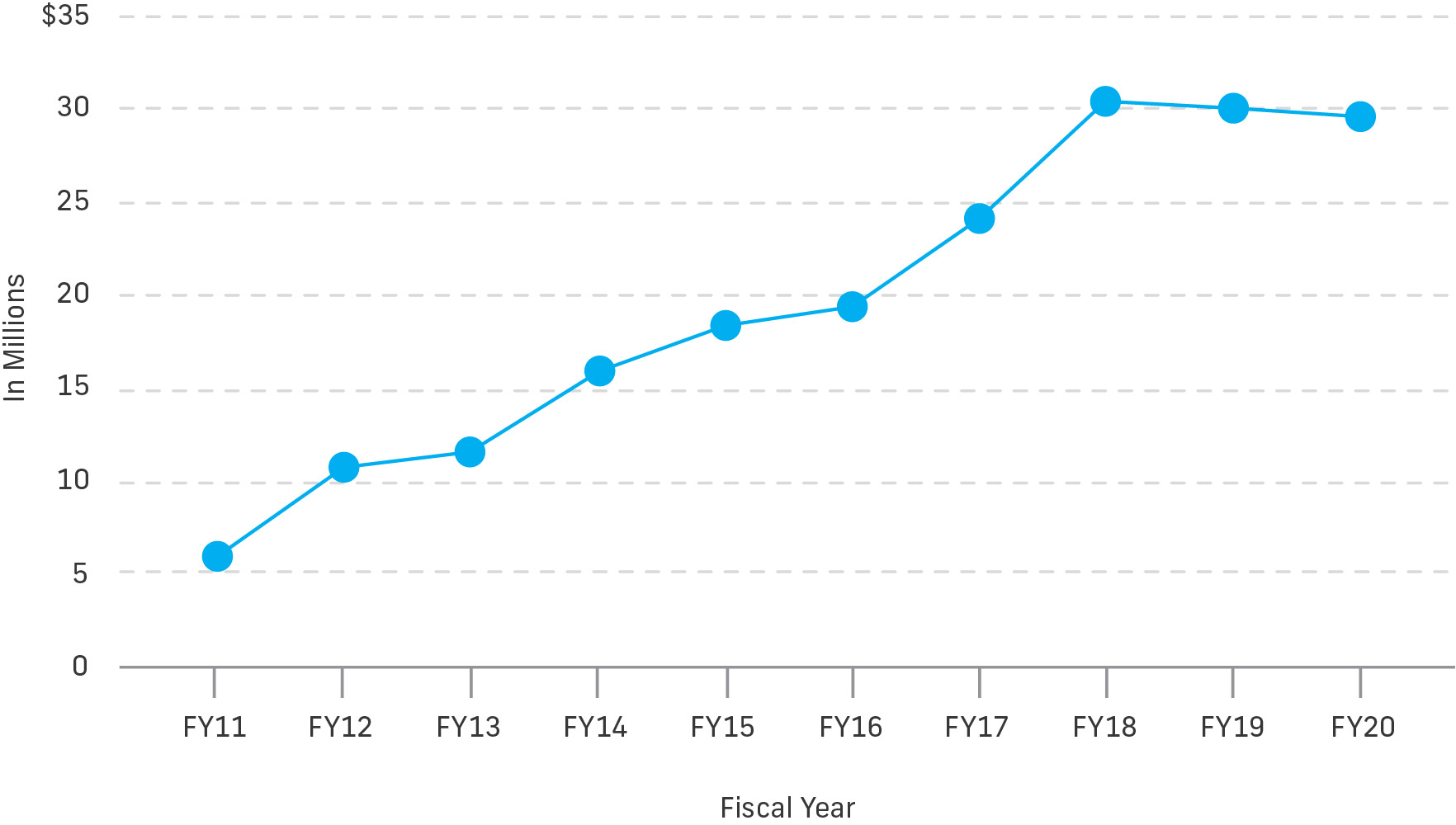

With $346.4 million in total assets, a portion of which is endowed to support academic initiatives, the Foundation provided approximately $29.9 million, including the state match on the First Generation Scholarship Program, in fiscal year 2019- 2020 to advance FIU’s mission. Funds were used to support a diverse student population, exceptional faculty, cutting-edge research, modern facilities, and collaborative engagement with our local and global communities.

The Foundation is governed by the Board of Directors that acts as the governing body of the organization. The board is responsible for governance, and the chief executive officer is responsible for management of the affairs of the Foundation.

Foundation Support of FIU Programs

Foundation’s Investment Portfolio Allocation

| Asset Class | June 30, 2020 Allocation | Asset Characteristics |

|---|

Public Equity | 51.5% | Capital appreciation, global diversification; highly liquid |

|---|

Private Equity | 18.6% | High return potential; illiquid |

|---|

Deflation Sensitive | 14.3% | Capital preservation and income generation; highly liquid |

|---|

Diversified Growth | 15.6% | Equity-like return potential with lower volatility; semi-liquid |

|---|

Investing in the Future of FIU

An endowment is the highest demonstration of a donor’s abiding belief in FIU and commitment to ensure its vibrant future. As the financial bedrock of the university’s drive to build excellence, endowments are vital to create and sustain important initiatives – scholarships, fellowships, faculty positions, and programs – in perpetuity. When a donor invests in FIU to establish an endowment, it creates a legacy that will provide permanent income to support a meaningful project while preserving the principal of the endowment. Any investment return over allowed spending is channeled back into the fund to increase growth.

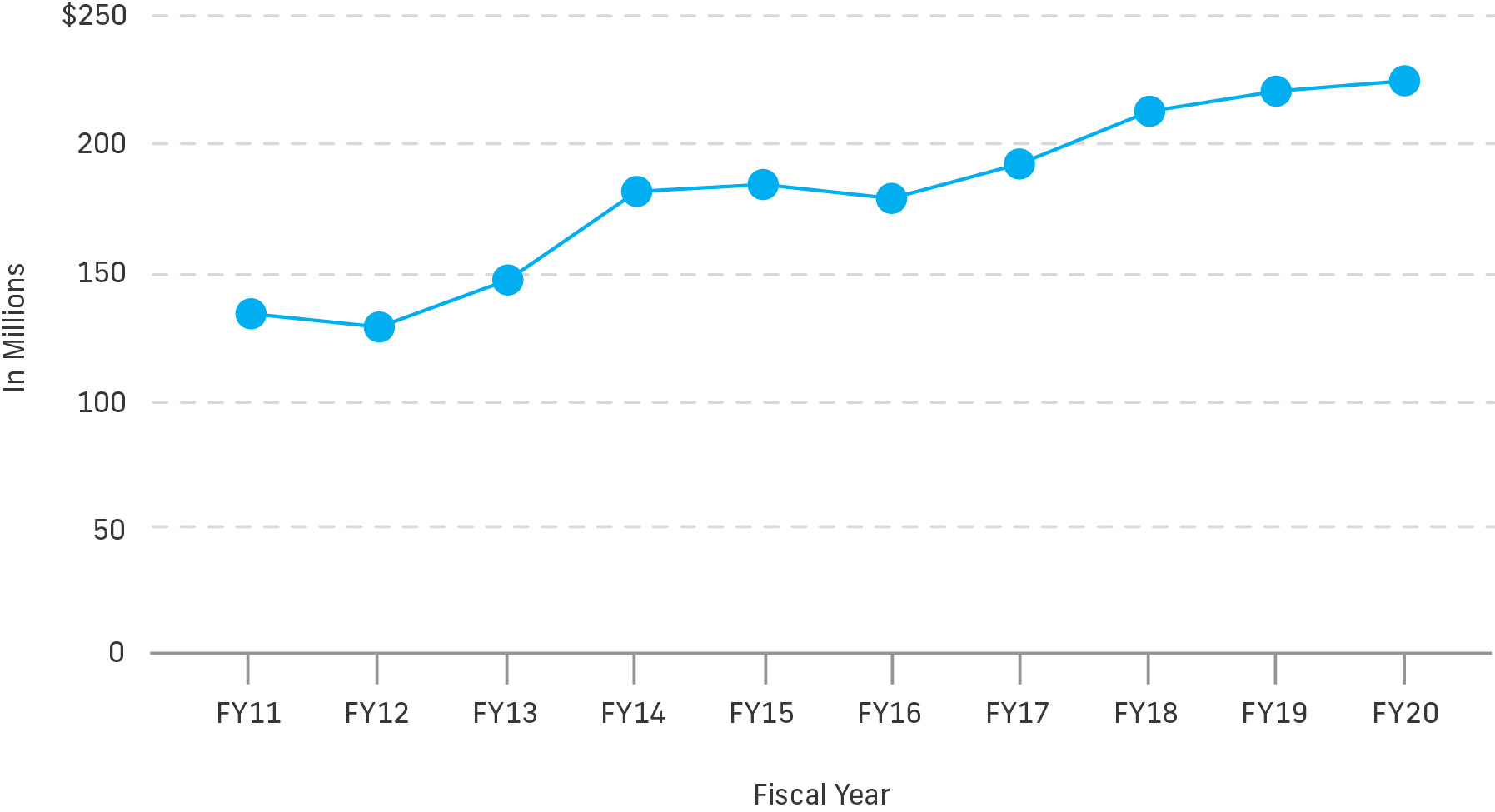

Endowment Market Value

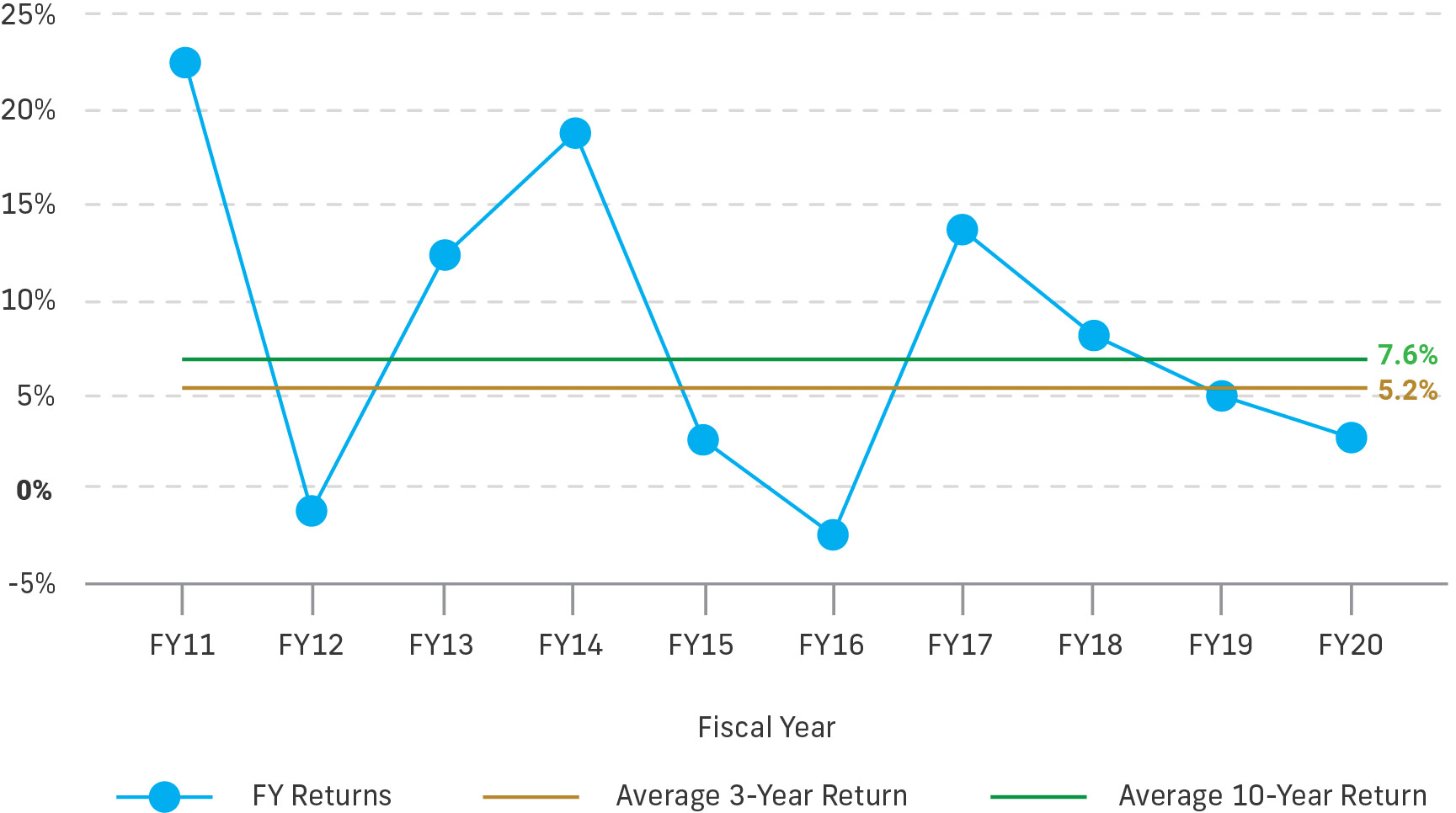

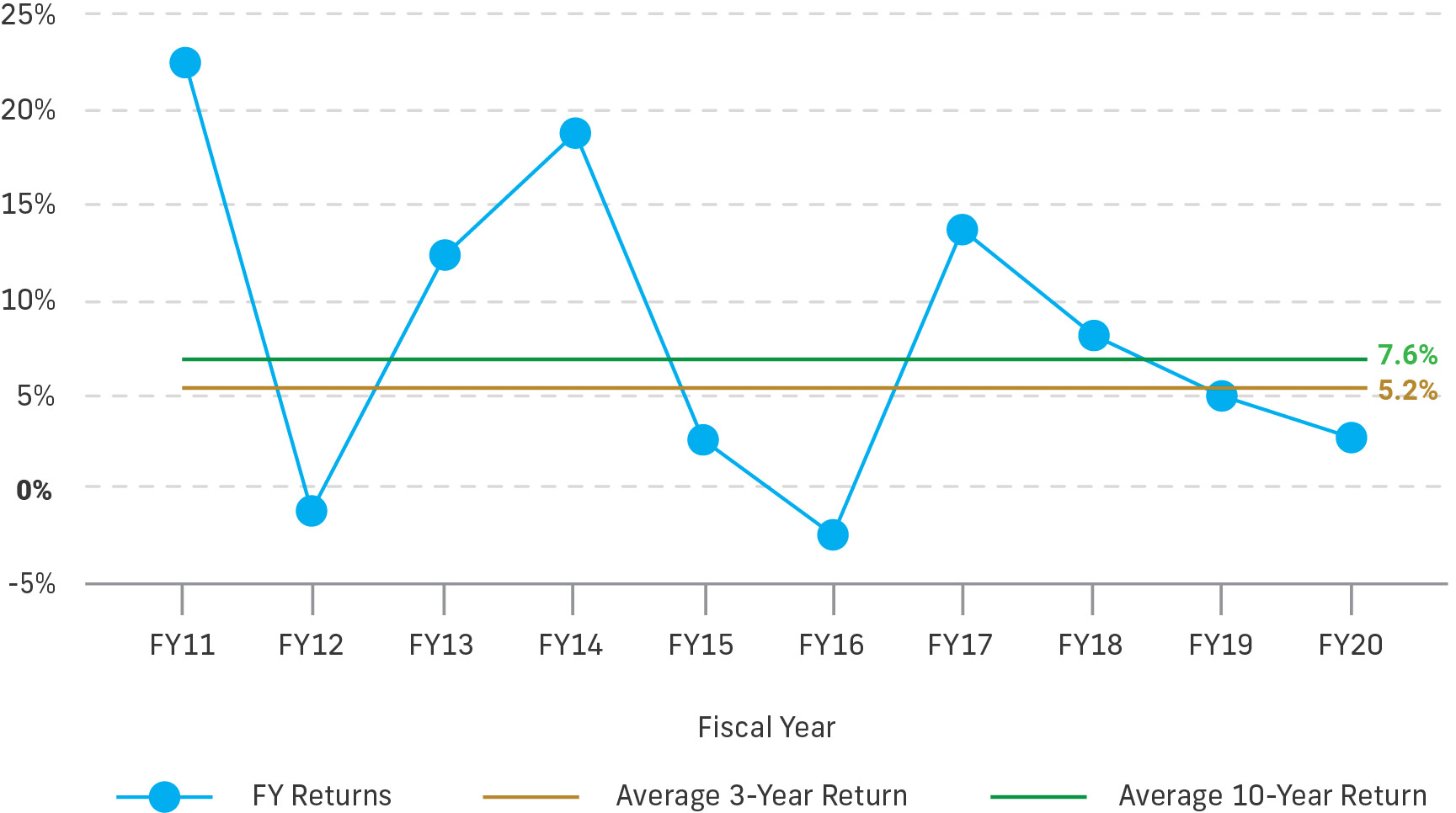

Investment Returns

Average 10-year return is 7.6%